Faith Nyasuguta

Kenya’s Finance Bill 2024 has emerged as a focal point of discussion and scrutiny within the financial and business sectors. This comprehensive analysis aims to dissect the intricate details of the defunct Finance Bill, exploring its intended implications on taxation, regulatory frameworks, and economic dynamics in Kenya.

By delving into the proposed amendments and their potential impact, this article seeks to provide a nuanced understanding of the changes that were set forth in the Finance Bill 2024.

Overview of the Finance Bill 2024

The Finance Bill 2024 represented a pivotal document that outlined the government’s fiscal policies, revenue-raising measures, and regulatory adjustments for the financial year. This bill introduced a series of amendments aimed at enhancing tax compliance, broadening the tax base, and fostering economic growth in Kenya. From VAT exemptions to income tax revisions, the Finance Bill encompassed a diverse array of proposals that were poised to shape the financial landscape of the country.

VAT Exemptions and Their Implications

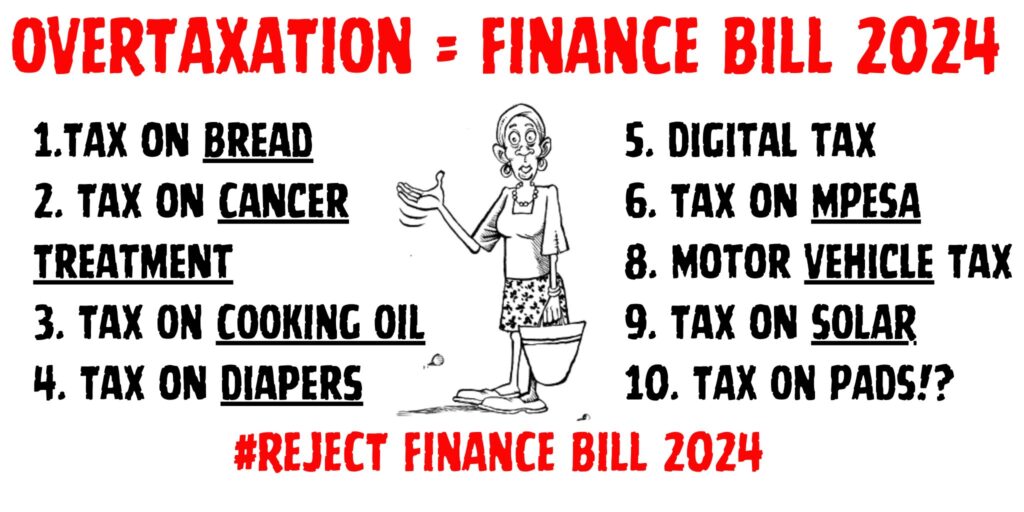

One of the key areas of focus in the Finance Bill 2024 was the revision of VAT exemptions across various sectors. The bill proposed the removal of certain VAT exemptions that were previously in place to incentivize specific industries, such as tourism, manufacturing, and construction.

By eliminating these exemptions, the government aimed to streamline the tax system, increase revenue collection, and promote equity in taxation. However, the removal of VAT exemptions could have had far-reaching implications on businesses operating in these sectors, potentially altering their cost structures and investment decisions.

Impact on Tourism and Manufacturing

The Finance Bill 2024 sought to remove VAT exemptions that were introduced to boost the tourism sector, such as exemptions on taxable goods and services used in the construction of tourism facilities and recreational parks. Additionally, the bill proposed the standard rating of betting, gaming, and lotteries services, which were previously exempt from VAT. These changes could have had significant ramifications for the tourism industry, potentially discouraging further investments and impacting the competitiveness of Kenya’s tourism offerings.

Furthermore, the removal of VAT exemptions for the manufacturing and construction sectors, including capital goods and specialized hospital construction, could have hindered investment incentives and impeded the growth of these industries. Businesses in these sectors might have faced increased tax liabilities, leading to higher operational costs and potentially affecting their profitability and expansion plans.

Implications on Tax Refunds, Regulatory Changes, and Economic Landscape

Tax Refunds and Regulatory Changes

The Finance Bill 2024 introduced significant amendments to the process of claiming VAT refunds and regulatory frameworks governing tax administration in Kenya. One of the key changes was the deletion of the provision allowing registered manufacturers to deduct input tax for supplies to official aid-funded projects. This alteration could have resulted in increased costs for manufacturers supplying such projects, potentially impacting pricing strategies and market competitiveness.

Moreover, the bill proposed regulatory adjustments in the issuance of objection decisions, emphasizing the importance of timely provision of information to the Kenya Revenue Authority (KRA) for efficient resolution of tax disputes. By deeming objections disallowed if additional information was not furnished within the specified period, the bill aimed to expedite the objection process and ensure fair and transparent tax administration.

Impact on Businesses and Taxpayers

The proposed increase in the VAT registration threshold from KES 5,000,000 to KES 8,000,000 was a notable development that could have alleviated the compliance burden for small businesses operating below the new threshold. While this adjustment was a positive step towards easing regulatory obligations, concerns persisted regarding the adequacy of the new threshold in reflecting the economic realities and inflationary pressures faced by businesses in Kenya.

Furthermore, the standard rating of betting, gaming, and lotteries services at 16% VAT could have had implications for both businesses in the gaming industry and consumers. The introduction of VAT on these services might have led to higher costs for consumers and potentially impacted the profitability of businesses operating in this sector. This change underscored the government’s efforts to broaden the tax base and enhance revenue collection in the country.

Sectoral Implications, Investment Incentives, and Sustainability Initiatives

Sectoral Implications of the Finance Bill 2024

The Finance Bill 2024 introduced sector-specific amendments that were poised to impact various industries in Kenya. One notable change was the deletion of VAT exemptions for specific financial services, including the issuing of credit and debit cards, telegraphic money transfer services, and foreign exchange transactions. By subjecting these services to the standard VAT rate of 16%, the government aimed to enhance revenue generation and promote equity in the taxation of financial transactions. However, this adjustment might have posed challenges for financial service providers and consumers, potentially leading to higher costs and changes in consumer behavior.

Furthermore, the deletion of VAT exemptions for financial services provided on a commission basis could have affected the operations of financial intermediaries and brokers, necessitating adjustments in pricing strategies and service offerings. The removal of these exemptions showed the government’s commitment to broadening the tax base and ensuring a more equitable tax regime across different sectors of the economy.

Investment Incentives and Economic Growth

The Finance Bill 2024 introduced changes aimed at incentivizing investment and fostering economic growth in Kenya. One such amendment was the expansion of the time frame for the issue of objection decisions, emphasizing the importance of timely resolution of tax disputes to provide certainty and clarity for taxpayers. By streamlining the objection process and setting clear timelines for the provision of information, the bill sought to enhance tax compliance and promote a conducive business environment in the country.

Moreover, the proposed amendments related to the claim of VAT refunds and the deletion of requirements for lodging claims within specific time frames could have simplified the refund process for taxpayers and reduced administrative burdens. These changes were designed to improve the efficiency of tax administration and enhance the ease of doing business in Kenya, thereby attracting investment and stimulating economic activity across various sectors.

Environmental Sustainability Initiatives

In line with global trends towards environmental sustainability and green finance, the Finance Bill 2024 sought to introduce provisions aimed at promoting eco-friendly practices and incentivizing investments in renewable energy and conservation initiatives. By aligning fiscal policies with environmental objectives, the government aimed to drive sustainable development, mitigate climate change impacts, and create a more resilient and environmentally conscious economy.

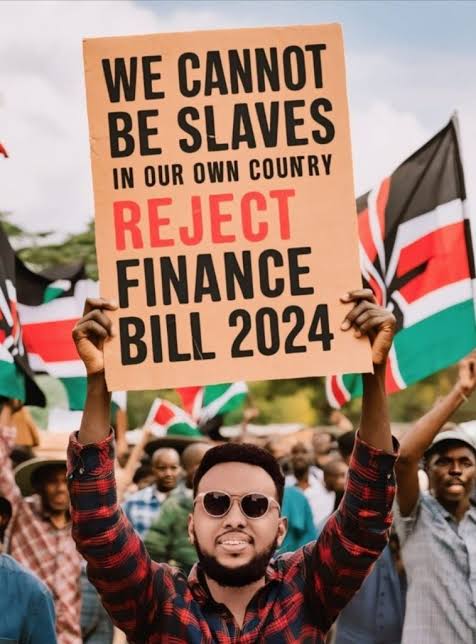

Political and Legislative Developments

Members of the National Assembly on June 25th voted to pass the contentious Finance Bill, 2024, amidst protests across the country. A total of 196 MPs voted to pass the bill, while 105 voted against it, with 3 votes being spoilt. A spirited push by a section of opposition MPs to have the final vote on the finance bill conducted electronically was rejected. This was after National Assembly speaker Moses Wetang’ula ruled that members would vote manually.

SUMMARY OF THE NOW DEFUNCT FINANCE BILL, 2024

Income Tax

Definition of Royalty The Bill aimed to change the definition of royalty to include any software, whether proprietary or off-the-shelf, and associated fees. This approach was controversial as it diverged from international best practices by taxing software purchases as royalties.

Definition of Donation The Bill sought to define donations as benefits given without any consideration, including money, promissory notes, or benefits in kind. This clarification was intended to specify which donations are allowable for tax purposes.

Deletion of Provisions Relating to Wife’s Income The Bill proposed removing the definitions of a wife’s employment, professional, and self-employment income, reflecting societal changes where individuals are independently liable for their taxes.

Deferment of Foreign Exchange Loss or Gain The Bill intended to limit the period for deferring foreign exchange losses from five years to three years. This change would have negatively affected taxpayers unable to claim such losses within the shorter period, creating uncertainty.

Withholding Tax on Payments for Supply of Goods to Public Entities The Bill proposed subjecting payments for goods supplied to public entities to withholding tax, ensuring that suppliers paid tax on income from government contracts.

Increase of Non-Taxable Benefits The Bill sought to raise the non-taxable daily allowance for employees working away from their usual place of work to 5% of monthly gross earnings and to increase non-taxable benefits limits for meals and other allowances.

Reimbursement of Expenses for Public Officers The Bill proposed that reimbursements for public officers’ official duties should not be considered taxable income.

Increase in Tax-Deductible Pension Contributions The Bill aimed to raise the limit for tax-deductible pension contributions from KES 20,000 to KES 30,000 per month, adjusting for inflation and changes in income over the past two decades.

Taxation of Income from Digital Marketplaces The Bill proposed taxing income from digital marketplaces at 5% for residents and 20% for non-residents, aiming to tax income from digital content monetization and services provided via digital platforms.

Repeal of Digital Service Tax and Introduction of Significant Economic Presence Tax The Bill intended to replace the digital service tax with a significant economic presence tax, charging non-residents 30% on profits from services provided through digital marketplaces in Kenya.

Introduction of Minimum Top Up Tax The Bill proposed a minimum top-up tax for persons with an effective tax rate below 15%, calculated on adjusted taxes versus net income or loss.

Introduction of Motor Vehicle Tax The Bill aimed to introduce a 2.5% motor vehicle tax, payable upon issuance of insurance cover, collected and remitted by insurers.

Diminution of Value of Implements, Utensils, or Similar Articles The Bill proposed allowing deductions for the diminution in value of implements or utensils used in income production, at a 100% rate.

Deductibility of Contributions to Social Health Insurance Fund, Post-Retirement Medical Fund, and Affordable Housing Levy The Bill sought to include contributions to these funds as allowable expenses up to KES 10,000 per month.

Repeal of Reliefs on Contributions to NHIF, Post-Retirement Medical Fund, and Affordable Housing Scheme The Bill proposed repealing tax reliefs for medical insurance premiums, NHIF contributions, post-retirement medical fund payments, and affordable housing savings.

Introduction of Advance Pricing Agreement The Bill aimed to allow taxpayers with related-party transactions to enter into advance pricing agreements with the KRA, valid for up to five years.

Automatic Approval of Change in Accounting Date The Bill proposed automatic approval of accounting date changes if no KRA response was received within six months of application.

Taxation of Clubs and Trade Associations The Bill proposed deleting the definition of gross investment receipts for member clubs and trade associations.

Repeal of Penalty on Underpayment of Installment Tax The Bill sought to repeal the 20% penalty for underpayment of installment tax.

Removal of Investment Deductions for Standard Gauge Railway The Bill proposed eliminating the 150% investment deduction for constructing bulk storage facilities supporting the Standard Gauge Railway.

Taxation of Amateur Sporting Associations The Bill intended to subject amateur sporting associations’ income to tax.

Taxation of Registered Trust Schemes The Bill proposed removing the tax exemption for income earned by registered trust schemes.

Taxation of Interest Income from Infrastructure Bonds The Bill aimed to tax interest income from infrastructure bonds, notes, and securities earned by residents.

Expansion of Tax-Exempt Pension Income The Bill proposed exempting pension benefits paid upon reaching retirement age from income tax.

Taxation of Income from Transfer of Property to Family Trust The Bill intended to tax gains from transferring immovable property to family trusts.

Deletion of Exemption for Income from Ajira Digital Program The Bill proposed deleting the tax exemption for income earned from the Ajira Digital Program.

Taxation of Amounts Withdrawn from National Housing Development Fund The Bill sought to tax amounts withdrawn by contributors for purchasing their first house.

Taxation of Non-Resident Contractors, Sub-Contractors, Consultants, and Employees The Bill clarified that non-residents’ income from grant-funded projects would be taxable.

Requirement to Deduct Withholding Tax Regardless of the Amount The Bill proposed subjecting all payments for management, professional, or contractual fees to withholding tax, regardless of amount.

Excise Duty

Introduction of Excise Duty on Internet and Social Media Advertisements The Bill aimed to introduce a 15% excise duty on fees for internet and social media ads related to alcohol, betting, gaming, lotteries, and competitions.

Increase in Excise Duty Rate on Money Transfer Services The Bill proposed raising the excise duty on money transfer service fees from 15% to 20%.

Deletion of Excise Duty Reliefs The Bill sought to remove excise duty reliefs for raw materials in manufacturing excisable goods and bulk internet data purchases for resale.

Changes to Excise Duty Rates The Bill proposed various changes to excise duty rates on motorcycles, sugar confectionery, alcoholic beverages, and tobacco products.

RELATED: