Staff writer

12.5% corporate tax rates of countries like Ireland are finally on the short end of the stick.

For many years, companies have shopped around for the lowest tax jurisdictions and registering their headquarters to evade host country’s tax rates.

The G20 summit in Rome has finally agreed to establish a 15% minimum global tax rate to stop the race to the bottom which has left many cash staved governments with very few options to provide effective public services.

Image credit: Celestino Arce /courtesy/

Some developing countries were seeking a higher rate and lamented that the low tax rate of 15% minimum has been set to serve the interests of richer nations.

Non-governmental Organizations (NGOs) criticized that the deal is laden with exemptions, with Oxfam International (a British founded confederation of 20 independent charitable organizations focusing on the alleviation of global poverty) saying it effectively had “no teeth.”

G20 is a group of 19 wealthiest countries in the world plus the European Union. South Africa is the only African country on the list.

The block was formed to unite the largest economies to better address political and socio-economical global challenges.

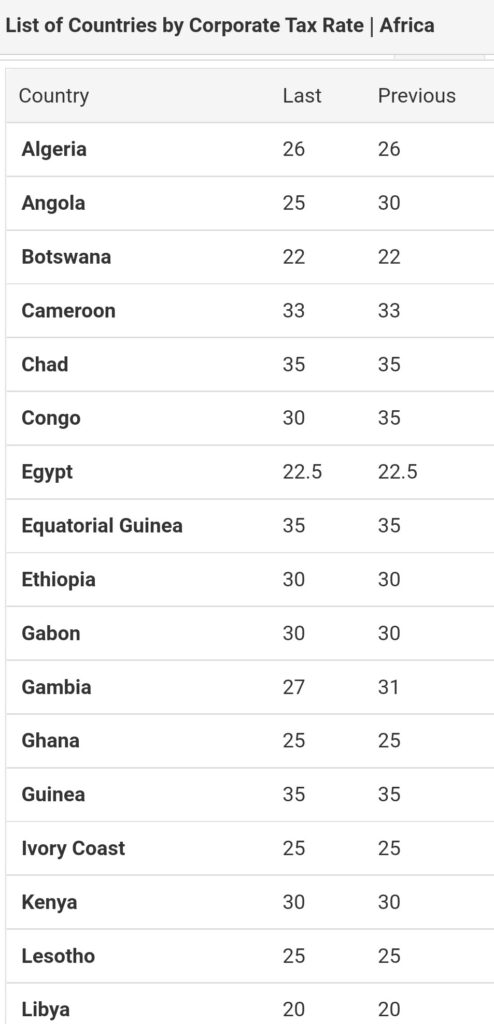

Africa has the highest average statutory corporate tax rate among all regions, at 28.50 percent. This is a deterent to foreign investments coming into the continent and establish manufacturing bases due to high taxation rates that seem punitive.

This also hinders local companies’ expansion, to re-invest and create more jobs. It is a self defeating economic policy to say the least.

Africa has tremendous investment opportunities because of the lower wage pressures compared to the developed world, yet because of high taxation rates, other bad economic policies and negative business environment; this potential goes untapped.

Below is a sample of African countries corporate tax rates.

The other G20 countries in alphabetical order include – Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom and the United States.

Image credit: Dreamstime /courtesy/

1 Comment

Economic argument –

HIGH TAX RATES –

– deter local & foreign business investments

– tax base narrows or doesn’t grow

– which in turn, necessitates govts. to hike taxes because of limited cash remittances

– job creation stalls, which in turn creates a demand for welfare for the unemployed

– and the cycle repeats

LOW TAX RATES –

– attract local & foreign business investments

– tax base expands or grows giving govts. more remittances to provide adequate public services, infrastructure development

– tax payers & companies have more $$ to spend on expansion/ production factors which in turn

fuels economic growth

– more economic expansion creates jobs, new businesses & more taxable income for infrastructure, public services etc… & keeps the tax rates low to repeat the cycle