Maina wa Njuguna

Timing, some say is everything. One of the world’s largest oil suppliers, Saudi Arabia 🇸🇦 led other major oil producers on Sunday astonishing many in announcing cuts totaling up to 1.15 million barrels per day from May until the end of the year.

What message is the Organization of the Petroleum Exporting Countries (OPEC) sending? Markets all over the world are reeling with high inflation that has proven so far to be as tough as nails.

OPEC was formed and headquartered in Baghdad, Iraq. It is composed of 13 member countries. OPEC’s combined rate of oil production (including gas condensate) represented 44% of the world’s total in 2016 and OPEC accounted for 81.5% of the world’s “proven” oil reserves. (Wikipedia)

We are still dealing with the vestiges of once in a lifetime Covid-19 pandemic that ravaged millions of people’s lives, the full scope yet to be fully realized.

Experts from the World Bank, the World Resources Institute (WRI) and other organizations warn that the coronavirus pandemic will leave behind about 100 million ‘new poor’ living in cities around the world due to job losses and income.

World Bank, World Resource Institute

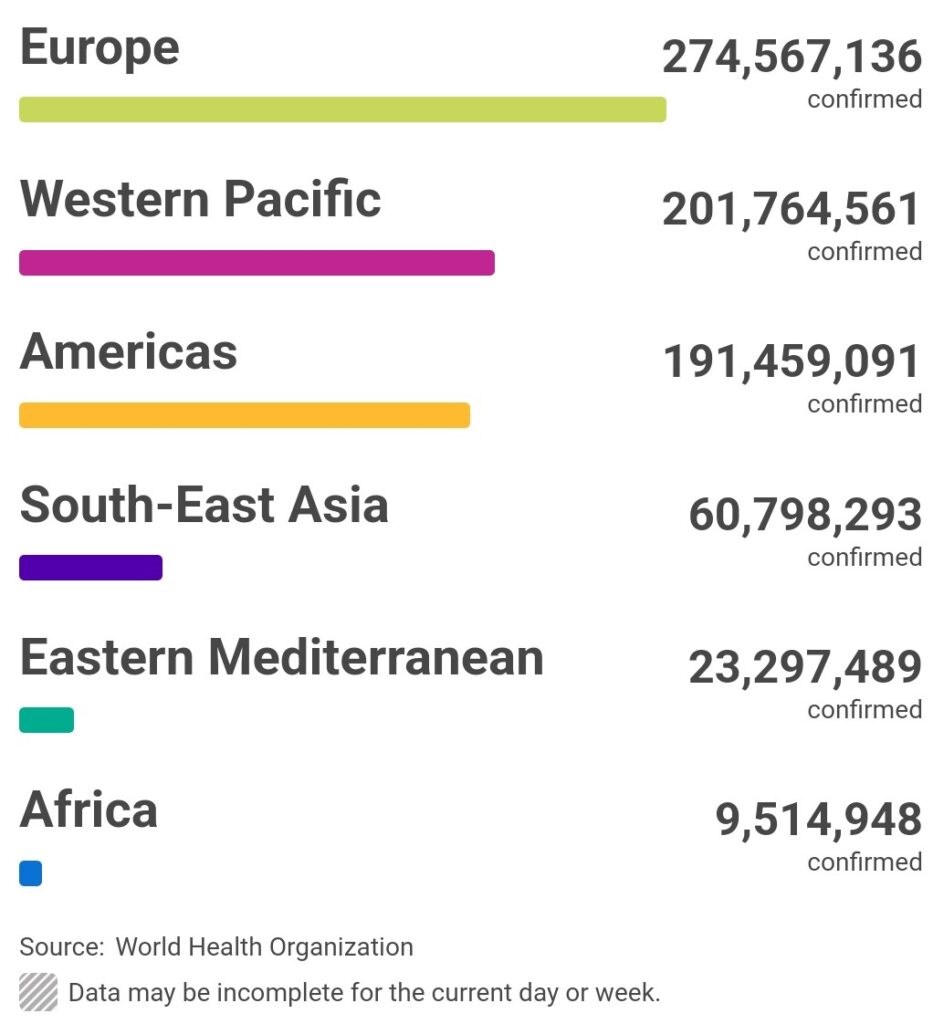

The World Health Organization (WHO) has comfimed Covid-19 cases as 761,402,282 and 6,887,000 deaths worldwide 🌐.

According to Kevin Book, Managing Director of Clearview Energy Partners LLC, the production cuts alone could push U.S. gasoline prices up by roughly 26 cents per gallon, in addition to the usual increase that comes when refineries change the gasoline blend during the summer driving season.

What does this potend for the Russian-Ukraine warfare? Could this mean a protracted war since higher oil prices means an increase to the Russian coffers? What impact would that have on food supplies since Ukraine is a major world food basket?

Basic economics means that the tightening of oil supplies translates to an increase in demand of the dwindling resource which results to higher prices worldwide.

The confluence of oil supplies challenges, market jitters, and global inflation problems does not board well for the global economy.

Saudi Arabia has its own domestic motivations per Kristian Coates Ulrichsen, a Gulf expert at Rice University’s Baker Institute for Public Policy – Saudis interests to keep oil prices high helps to fund a barrage of ambitious mega-projects linked to Crown Prince Mohammed bin Salman’s Vision 2030 plan to overhaul the economy.

Oil is one of the most important commodities in the world – petroleum products are ingredients of products such as plastics, chemicals, fertilisers, medicine, clothing, and fuel for transportation.

A change in oil demand and supplies means a change that will be felt deeply and widely especially in developing countries.