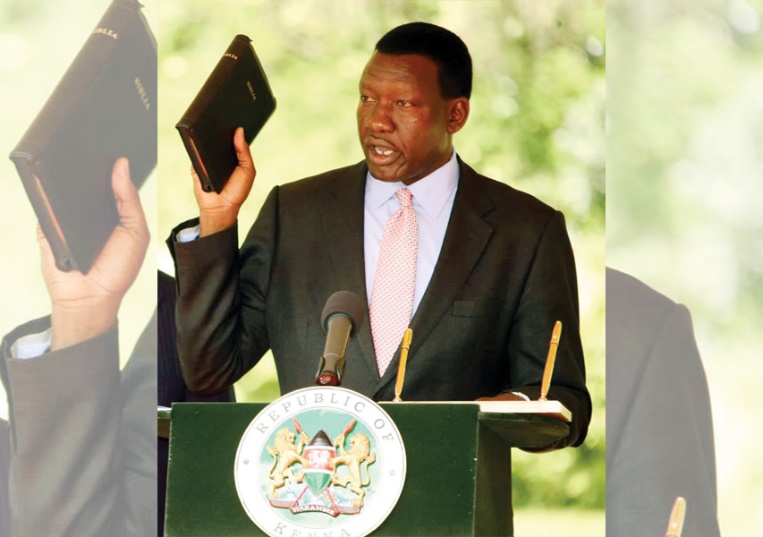

Renson Mwakandana

Despite a decline in oil prices, Kenyan fuel costs will stay high for at least another two months. Oil imported at the current worldwide market rates will begin selling locally in April or May, according to Energy and Petroleum Cabinet Secretary Davies Chirchir, which is when the reprieve would start to be felt locally.

“We bring our oil products into the country through an open tender system and we buy them on Platts pricing (latest market prices). But we do buy on M+2 (for two months from now) basis, so we’re now processing for April/May,” Chirchir said to reporters during a news conference on Monday.

Despite the price of petroleum falling from $92.61 per barrel then to $73.39 this month, Kenya’s gasoline price has remained constant at roughly Ksh177 ($1.419) per liter since November of last year.

Tanzania now has the lowest gasoline prices in the area ($1.2 per liter), followed by Uganda ($1.35) and the DRC ($1.417 and $1.39, respectively). Tanzanians protected from suffering from increasing fuel prices

Upon imposing price limitations on February 14, the Energy and Petroleum Regulatory Authority (Epra) stated that the rates would apply to petroleum that was already on the market, “so that importation and other responsibly spent expenditures be recovered while guaranteeing appropriate prices for consumers.”

By a government-to-government (G2G) collaboration with Middle Eastern oil-producing nations, according to Minister Chirchir, there are intentions to lessen the impact of “dollar pressure” on the price of petroleum. This relationship is anticipated to materialize in April or May of this year.

Under the G2G framework, he added on Monday, “we want to make sure that we are able to be allowed to defer payments for a few months, so that we do not create a major pressure on the foreign currency.”