Faith Nyasuguta

A fresh report by research firm New World Wealth and Henley & Partners has ranked Nairobi, Kenya🇰🇪 fifth in terms of the number of dollar millionaires in Africa.

The Henley Global Citizens Report, which tracks private wealth migration trends worldwide, shows Nairobi has 5,000 high net worth individuals (HNWI) with at least $1 million.

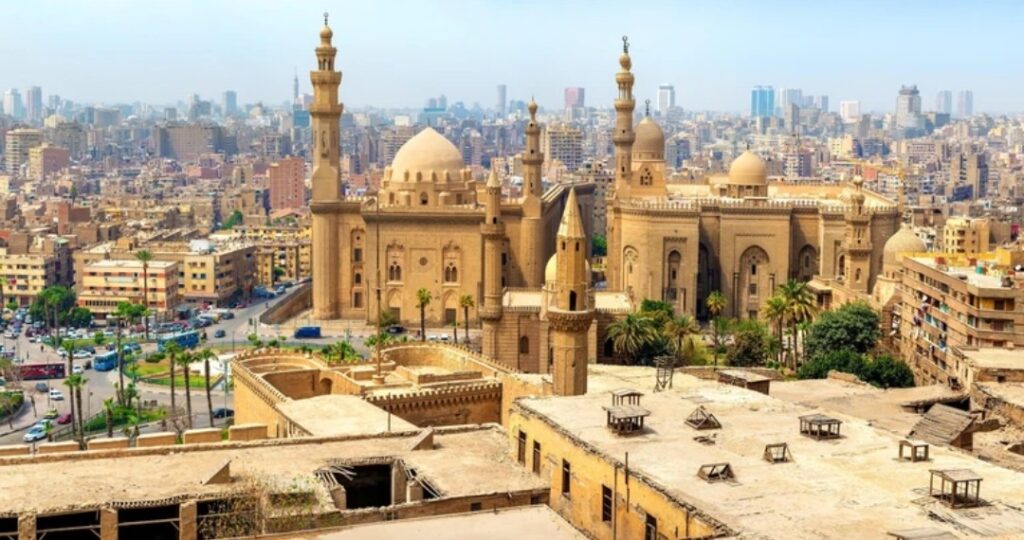

The same report shows that South Africa’s 🇿🇦business hub Johannesburg has 15,200 dollar millionaires – the most in Africa – followed by Egypt’s 🇪🇬 capital Cairo, which has 7,800 HNWIs.

In addition, South Africa’s 🇿🇦 Cape Town has the third largest concentration of wealthy individuals on the content with 6,800 HNWIs followed by Nigeria’s 🇳🇬 most populous African city, Lagos, which has 6,300.

Despite the high numbers, no African city made it to the list of top 20 cities globally that have the highest number of dollar millionaires. The list was dominated by US cities.

The US most popular city, New York has the largest concentration of dollar millionaires in the world, home to 345,600 HNWIs, followed by Tokyo and the San Francisco Bay Area with 304,900 and 276,400, respectively.

20 WEALTHIEST CITIES

According to Henley & Partners Chief Executive Juerg Steffen ,14 of the top 20 wealthiest cities in the world are in countries that host formal investment migration programmes, and actively encourage foreign direct investment in return for residence or citizenship.

“The right to live, work, study, and invest in leading international wealth hubs such as New York, London, Singapore, Sydney and Toronto can be secured via residence by investment. Individuals of talent and means should not limit their lives and business interests to one country,” said Dr Steffen.

The report detailed that Nairobi is also home to 240 multi-millionaires, who have a net worth of more than $10 million (Sh1.2 billion), and 11 centi-millionaires, who are worth more than $100 million (Sh12 billion). Kenya’s capital, however, does not have a dollar billionaire.

“Being able to relocate yourself, your family, or your business to a more favourable city or have the option to choose between multiple residences across the world is an increasingly important aspect of international wealth and legacy planning for private clients,” he said.

TOUGH FINANCIAL ENVIRONMENT

The number of dollar millionaires in Nairobi has, however, fallen 7 per cent in the six months to June, underlining the economic difficulties facing investors amid a tough economic environment driven by inflation.

Inflation – which hit a five-year high last month – has negatively affected consumption, causing private sector growth to shrink for five consecutive months to July.

Stanbic Bank Kenya’s purchasing managers index, which tracks the output of firms in the private sector, dropped to 46.3 in July from 46.8 in June, signalling a solid decline in the health of the Kenyan private sector.

It was noted that the underperformance of the private sector has badly hit wealthy investors, many of whom scaled back on investment in the run-up to the August polls.

Kenya has 8,500 dollar millionaires, according to the Africa Wealth Report 2022, which was released by the same firm in April. This means that Nairobi is home to 59 per cent of Kenya’s HNWIs, underlining its status as Kenya’s economic hub.

The report has tipped cities with rich oil and gas industries such as Angola’s Luanda to produce a higher number of new dollar millionaires in the coming months owing to the prevailing high global crude oil prices.

It shows more investors are flocking to tax havens in the Caribbean that offer citizenship by investment options such as Grenada, St. Kitts and Nevis, and St. Lucia.