Faith Nyasuguta

A multimillion-dollar agreement signed between the Emirati maritime giant DP World and Tanzania on Sunday appears set to further strengthen the United Arab Emirates (UAE)’s influence in Africa’s freight industry.

Reports of the $250 million deal emerged in July, sparking criticism from the opposition, who argued it “violated Tanzania’s constitution and endangered national sovereignty.” Activists who petitioned to halt the deal were briefly detained for planning anti-government protests.

The high court in Tanzania’s southwestern town of Mbeya dismissed the petition, allowing DP World to manage two-thirds of the Dar es Salaam port for the next 30 years.

Transport Minister Makame Mbarawa assured that there would be no job losses, and Tanzania would retain 60% of earnings. DP World aims to triple revenue within a decade and reduce vessel clearance times from 12 hours to 60 minutes.

Chronic inefficiency, allegations of corruption, and competition from neighboring Kenya contributed to Tanzanian President Samia Suluhu’s decision to approve the agreement.

“People have a right to raise concerns because this is a democracy. And it is the government’s job to act,” she said during the signing in the administrative capital, Dodoma, downplaying public disquiet.

WORLD POWER COMPETITION

The UAE, the fourth-largest investor in Africa after China, Europe, and the US, has invested nearly $60 billion in infrastructure and energy sectors on the continent over the past decade.

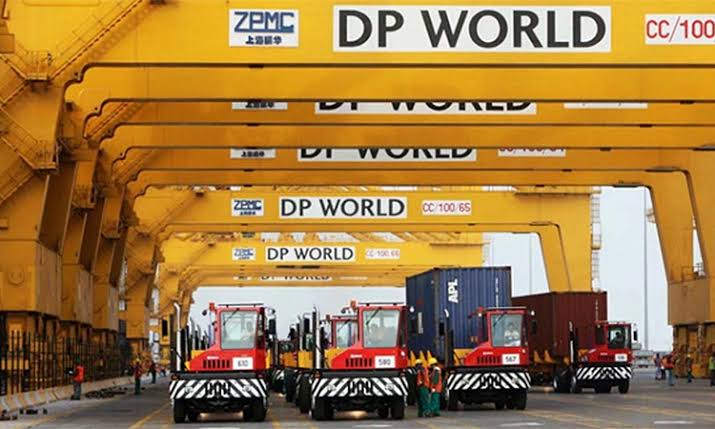

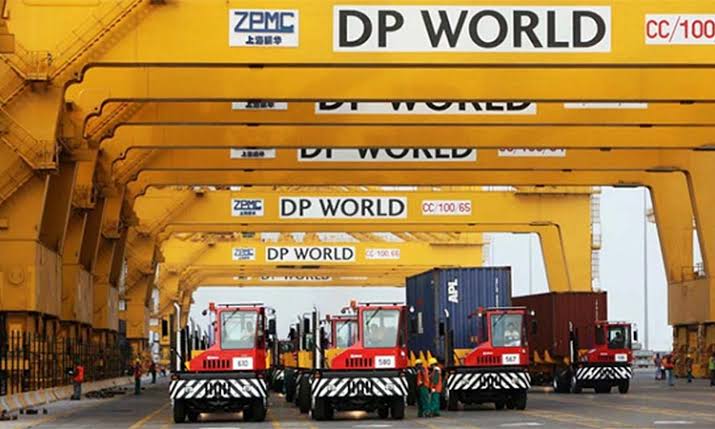

DP World – established in 1999 and owned by Emirati ruling families – has increased those inroads with port operations in Angola, Djibouti, Egypt, Morocco, Mozambique, Senegal and Somalia.

In 2021, DP World pledged to invest $1bn in Africa over the next several years.

These investments have at times sparked tensions, tested geopolitical relations and – more crucially – intensified competition for infrastructural development in Africa.

Like China, Turkey and Russia, the UAE is increasingly becoming a political and economic counterweight to the West in Africa.

Abu Dhabi’s diplomatic presence has grown through humanitarian support and defense cooperation, particularly in the Horn of Africa.These investments have at times sparked tensions, tested geopolitical relations, and increased competition for infrastructure development in Africa.

As a result, the UAE holds a dominant position in the Red Sea region, just north of Tanzania. Its developments in Somali ports and operations in disputed regions have raised concerns, but DP World has continued its operations despite political pressure.

The lengthy lease of the Dar es Salaam port in Tanzania is consistent with DP World’s approach in other parts of Africa. The firm has secured long-term agreements in Senegal and Angola and is involved in major port projects, such as DR Congo’s deep-sea port in Banana, set for completion by 2025.

Part of the controversy surrounding DP World’s presence in Tanzania is the perception that its operations undermine local rights and management. DP World Group’s CEO, Sultan Ahmed Bin Sulayem, has emphasized the goal of making the Dar es Salaam port a “world-class facility.”

President Suluhu, who succeeded John Magufuli in 2021, has sought partnerships with the UAE to address challenges and seize opportunities swiftly. DP World remains instrumental in the UAE’s geopolitical ambitions in Africa.

These relationships have given DP World a near monopoly in the Red Sea region, just north of Tanzania. They have also allowed the UAE to consolidate defence interests in the Gulf of Aden as part of an almost decade-long military offensive in Yemen.

As a result, the UAE – despite its size – has an edge over other Gulf nations as the Horn of Africa is a strategic route for crude oil exports.

DP World’s developments in Somalia’s Bossaso port and Berbera in the self-declared republic of Somaliland amount to almost $1bn.

The agreements caused a row with the Somali federal government, which considers Somaliland to be part of its territory and has often had a turbulent relationship with the semi-autonomous Puntland region, which includes Bossaso. But DP World appears to have shrugged off political pressure to continue operations in both regions.

Its forays in Djibouti – a combination of military real estate and one of the busiest shipping routes in the world – could serve as a cautionary tale. Djibouti’s attempt to take control of the Doraleh Container Terminal, a major revenue source and employer, from DP World ignited a costly legal dispute.

In 2018, Djibouti handed the terminal to China Merchants Port Holdings, a Hong Kong-based company, in protest against DP World’s decision to grant access to Ethiopia and Somaliland.

DP World, holding a 50-year concession since 2006, contended that this changeover violated its “exclusive access” rights. A Hong Kong appeals court ruled in favor of DP World, ordering Djibouti to pay over $600 million in damages.

DP World’s tendency to secure lengthy leases is not unique. Its agreements on the Atlantic coast of Africa have similarly involved long-term commitments. In 2007, DP World outbid French interests to win a $1.13 billion contract for the Ndayane port near Dakar, Senegal, which it will manage for 25 years.

The firm is poised to earn over $400 million through a multi-purpose terminal concession agreement with Angola. Amidst these developments is the $1.2 billion deep-sea port in Banana, DR Congo, set for completion by 2025.

Concerns regarding DP World’s presence in Tanzania revolve around the perception that its operations are eroding local rights and management.

DP World Group boss Sultan Ahmed Bin Sulayem said while in Dodoma that the Dar es Salaam port will become a “world-class facility”.

DP World remains an anchor for the UAE to extend its geopolitical ambitions across Africa.

RELATED: